Record $1.7M Bad Faith Insurance Verdict, a Game-Changer for Louisiana Homeowners

Record $1.7M Bad Faith Insurance Verdict, a Game-Changer for Louisiana Homeowners

On March 29, a federal judge in the Western District of Louisiana awarded $1.7 million in damages to a local businessman who had filed a bad faith insurance lawsuit against Scottsdale Insurance Co, in a dispute over a claim for losses caused by Hurricane Laura in 2020. After a four-day trial, the jury in the Lake Charles Court found that Scottsdale Insurance Co had delayed processing of the claim presented by the owner of Eaux Holdings LLC. The problem is not new, or uncommon. Many Louisiana policyholders are faced with similar delay tactics. According to the law, once proof of loss is established, insurance companies must settle a claim in 30 days. If they fail to pay and it is determined they did that in bad faith, insurance companies can be slapped with a 50% penalty, under the Louisiana Revised Statute 22:1892. The Lake Charles Court’s decision to impose stiff bad faith penalties is viewed as a game-changer for both parties. While insurers in the state moan about the financial losses they have sustained over the past few years, homeowners throughout the state can hope insurance companies will be moved into action.“With so few insureds stepping up, fighting, and hiring a specialist to assist them, insurance companies just play the shuffle game and wait until the legal time period expires on the insured’s claim. At that point, they are off the hook, no matter how bad the insurance company adjusts the loss,” Brian Houghtaling of the Houghtaling Law Firm, LLC, told Law360. With over 20 years of experience in the field, Houghtaling handled thousands of property damage insurance claims and knows everything about the delay and underpay tactics insurers in Louisiana use.At present, thousands of Louisiana homeowners are still struggling to recover damages from last year’s Hurricane Ida. Under Louisiana law, homeowners have 180 days to file a claim and submit proof of loss. The main problem is that insurance companies in Louisiana have been increasingly using a technique known as adjuster shuffle or adjuster churning.

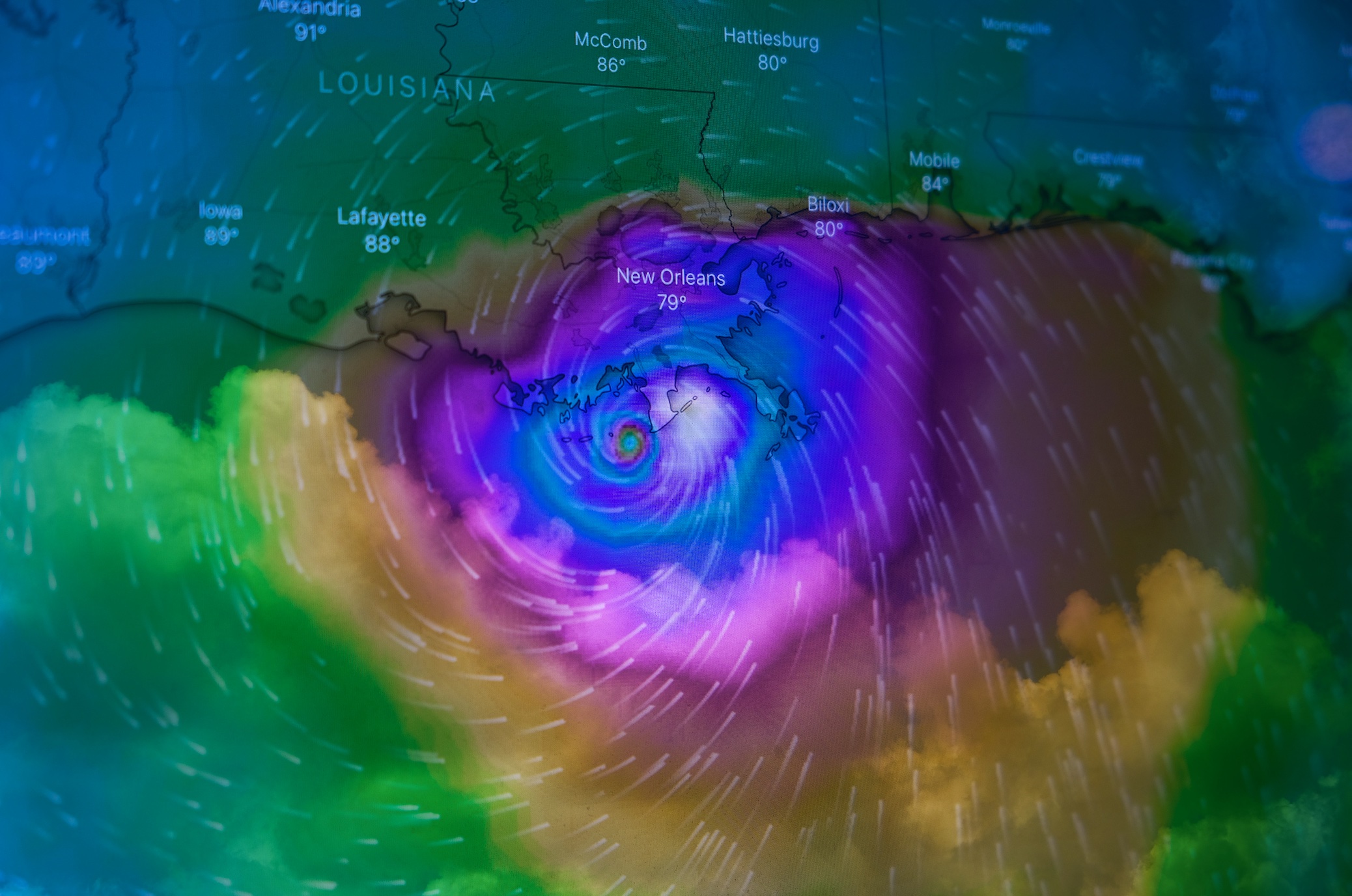

Double exposure of Hurricane Ida approaching New Orleans on August 29, 2021; image by Brian McGowan, via Unsplash.com.

Double exposure of Hurricane Ida approaching New Orleans on August 29, 2021; image by Brian McGowan, via Unsplash.com.

About Peter Charles

Having graduated from Saint John’s University in 1993, Peter Charles, Chief Operating Officer, brings a dynamic 28-year sales career reflecting pioneering experience and record-breaking performance in the computer and internet industries. He remains on the industry’s cutting-edge, driving new business through key accounts and establishing strategic partnerships and dealer relationships to increase channel revenue. He is currently focused on providing multiple revenue streams for USAttorneys.com. He can be reached at 800-672-3103.