How Financial Management Practices Affect Business's Credits and Debts

How Financial Management Practices Affect Business's Credits and Debts

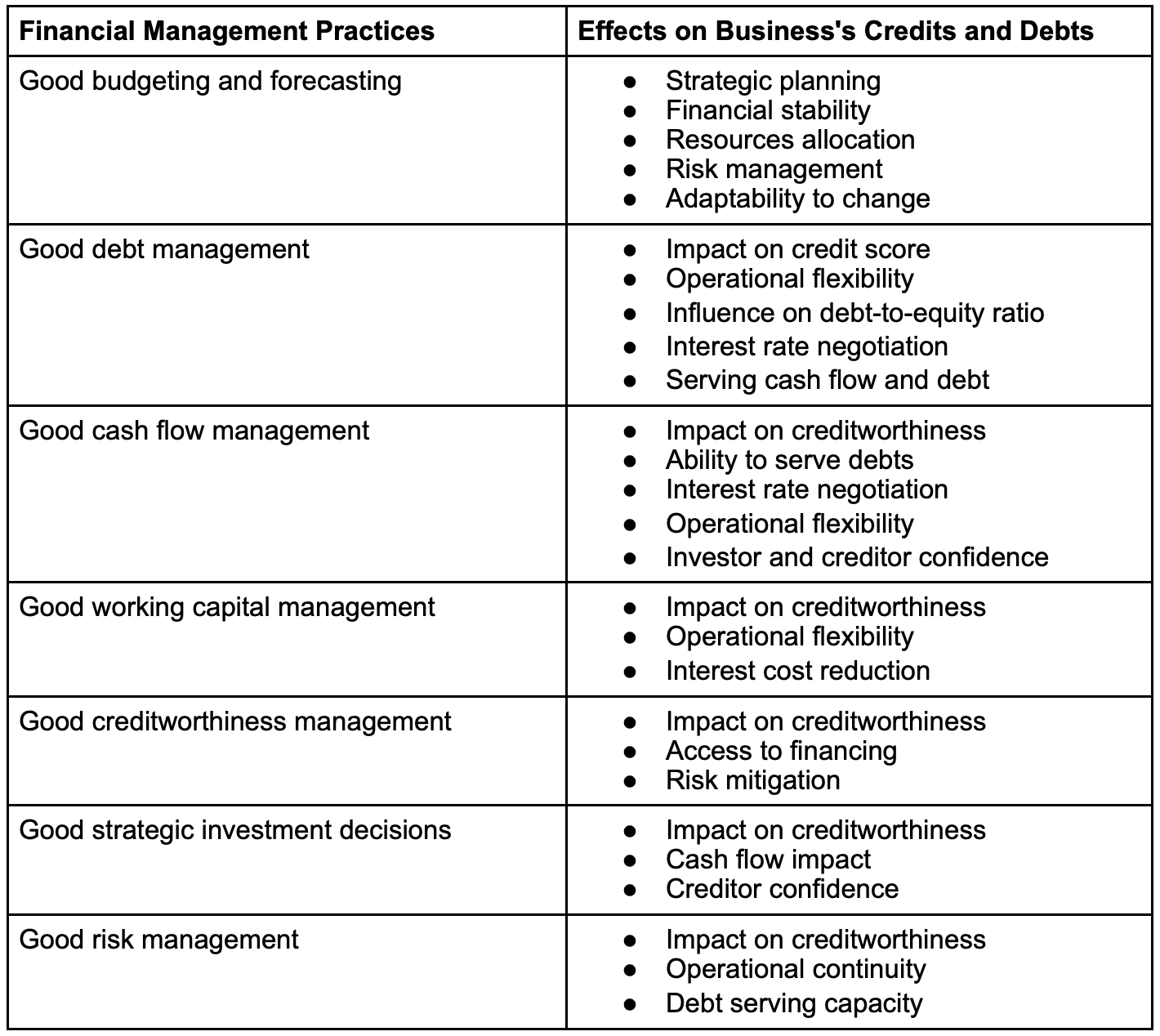

Financial management significantly impacts the delicate balance of a company's credits and debts, shaping a business's creditworthiness and influencing its debt dynamics. In this article, we’ll explain why financial management practices are closely connected to a business's credits and debts. We'll discuss various aspects, from smart budgeting to wise investment choices, to show how these strategies can strengthen or weaken a business's standing in terms of credit and debt. Financial Management Practices and Business's Credits and Debts Connection TableThe table below is a visual representation of these key financial terms and how they are intertwined:

Visual representation of key financial terms; chart courtesy of author.

Visual representation of key financial terms; chart courtesy of author.

Prompt debt management directly affects a business's credit score, influencing its credibility and ability to secure favorable credit terms.

It offers businesses operational flexibility by allowing them to navigate uncertainties and pursue strategic initiatives without becoming excessively burdened by debt obligations.

Debt management practices shape the debt-to-equity ratio, a critical metric influencing how creditors and investors perceive a business.

Effective debt management may allow businesses to negotiate lower interest rates, reducing the financial burden of serving debts.

It ensures that debt servicing aligns with the company's cash flow, avoiding liquidity challenges and potential defaults.

It impacts a business's creditworthiness, influencing its ability to secure favorable credit terms and maintain financial credibility.

Effective cash flow management ensures a business can meet debt servicing obligations, reducing the risk of defaults and maintaining positive relationships with creditors.

It enhances a business's negotiating power for lower interest rates, ultimately reducing the financial burden of serving debts.

Well-managed cash flow provides operational flexibility. It allows businesses to adapt to changing market conditions, invest in growth, and maintain financial resilience.

It portrays a commitment to responsible financial practices and building positive financial relationships.

Strategic working capital management influences a business's creditworthiness, allowing it to secure favorable credit terms.

It promotes operational efficiency, allowing businesses to maintain smoother cash flow cycles and reduce the reliance on external financing.

Optimized working capital can contribute to reducing interest costs, as businesses can operate with lower debt levels and negotiate better terms with creditors.

About Nadya Morison

Nadya Morison, who is a data analyst, content researcher, and journalist. Connect with her on LinkedIn.